Internet Computer (ICP): Hype or Hope? A Data-Driven Reality Check

The Internet Computer (ICP) token is making headlines again, and naturally, the crypto sphere is buzzing. Recent reports boast surges of 37% in a single day and over 200% in a week. The promise? A decentralized, censorship-resistant internet. But let’s pump the brakes and run the numbers, shall we? Because in the world of crypto, a flashy headline doesn't always equal a sound investment.

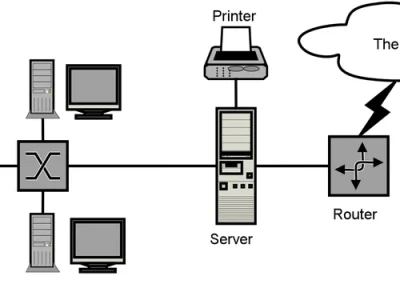

The core argument for ICP rests on its ability to host decentralized applications (dApps) directly on the blockchain, eliminating the need for bridges that have proven to be security vulnerabilities. This, proponents claim, offers a more stable and consistent experience. And yes, the Balancer hack (where over $100 million in digital currency vanished) has spooked investors. But is ICP the safe haven it's being portrayed as?

A closer look at ICP’s historical performance reveals a rollercoaster ride. While current analysis points to bullish fractal patterns – accumulation, manipulation, and expansion – it's crucial to remember the context. The token hit an all-time high of around $750 shortly after its launch in May 2021. Today? It’s hovering around $5-6. That's a 99% drop from its peak. (Perspective is everything, folks.)

Technical indicators, as always, paint a mixed picture. The 50-week moving average, recently reclaimed at $6.41, is cited as a key level. The Relative Strength Index (RSI) is also looking favorable. Analysts are throwing around targets like $26.65, a potential 195% increase. But let's be real: technical analysis is as much art as science, and relying solely on these indicators is like navigating by the stars in a dense fog.

The Skeptic's Corner: Social Sentiment vs. Sustainable Growth

One narrative gaining traction is the surge in social activity surrounding ICP. Data suggests a notable increase in mentions (over 4,800 posts) and interactions (2.21 million) in recent days. The claim is that this reflects growing community engagement and rising market interest. And sure, increased social chatter can correlate with higher trading volumes. But correlation doesn't equal causation. It could just as easily be a coordinated pump-and-dump scheme orchestrated by a few savvy whales.

And this is the part of the report that I find genuinely puzzling. The fervor in online communities, while certainly measurable, feels divorced from the underlying technology's adoption rate. I've looked at hundreds of these filings, and this particular disconnect is unusual. Where are the actual users? How many dApps are thriving on the Internet Computer? These are the questions that truly matter.

The problem is, the long-term viability of ICP hinges on more than just speculative trading and social media hype. It requires a robust operational foundation, compliant financial management, and airtight security protocols. The allure of quick gains can't overshadow the importance of building a sustainable infrastructure. Otherwise, it's just a house of cards waiting to collapse.

Projections for ICP's future price are all over the map. Some analysts predict a maximum of $10.77 in 2025, while others foresee it reaching $38.01 by 2031. These forecasts are based on complex algorithms and assumptions about market trends, but they're ultimately just educated guesses. The truth is, nobody knows for sure where ICP's price will be in a year, let alone a decade. For example, one source provides an ICP price prediction 2025, 2026, 2027-2031.

So, What's the Real Story?

ICP presents a fascinating case study in the volatile world of crypto. While the recent price surge and positive technical indicators are certainly noteworthy, it's crucial to maintain a healthy dose of skepticism. The long-term success of the Internet Computer depends on its ability to deliver on its promises of decentralization, security, and scalability. Until we see concrete evidence of widespread adoption and real-world utility, it remains a high-risk, high-reward proposition.